I hope the weatherman proves to be correct in his forecast! I also hope that your project forecasts prove to be more correct after this series of posts about forecasting. Though the crystal ball is often just as foggy as the mountain mornings, we can practice reading the scenario of the project landscape and apply the appropriate forecasting method.

For the PMP® Exam candidate, there are four specific scenarios with respective forecasting approaches than may appear on the exam. I’ve highlighted three in previous posts, but today I want to focus on the scenario that I like to call the “Double Whammy.”

The first whammy (http://dictionary.reference.com/browse/whammy) has already been discussed – when the Cost Performance Index (CPI), or spending efficiency, is less than 100%. We can expect the forecasted Estimate At Complete (EAC) to be higher than the Budgeted At Completion (BAC) since the project is spending more money than planned to achieve the project’s value. If the spending efficiency is not expected to improve, then the forecast is to finish over budget.

Don’t overlook the second whammy as you forecast the project’s performance! What about your project’s working efficiency? The Schedule Performance Index (SPI) comes into play as well regarding the financial performance of the project. If the project team is progressing at the planned rate of progress, then the SPI is 100%. However, if the project team is progressing at a rate 75% of the planned rate, then the working efficiency, or SPI, is said to be 75%. To place it in realistic terms, if your work crew took unplanned 15-minute breaks every hour, they would only achieve 75% of the work that they could achieve if they worked the entire 60-minute hour.

“So, Louis, how does a poor SPI impact the project’s financial performance?”

In short – negatively! Let’s dig deeper. If your project is behind schedule, then more time than planned will be necessary to complete the project activities. If you have variable project costs, such as direct labor costs, rental equipment, or time and material agreements associated with your project, then lengthening the project life directly increases the sum of these variable costs. There are several other ways to explain higher costs due to longer schedules – but these cost drivers will be specific to each particular project.

“OK, so how do I take poor working efficiency into account in my forecast?”

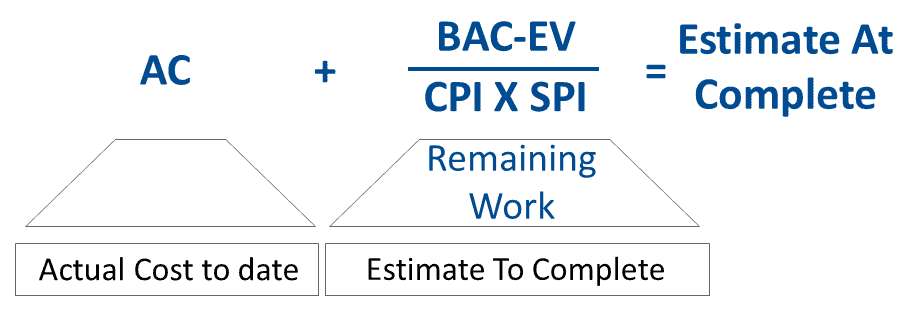

Our cost accountants have already told us the Actual Costs to date (AC), so we just have to forecast the Estimate To Complete (ETC) to derive the Estimate At Complete (EAC). The remaining work to be performed is the BAC minus the EV (the budgeted value of the total project minus the budgeted value of the work already performed). We already know how to apply the poor spending efficiency – just divide the remaining work by the CPI. To take the poor working efficiency into account, similarly divide the remaining work by the SPI. In effect, the resulting formula is depicted in the following diagram:

Remember, the double whammy comes into play when:

- CPI is less than 100% (spending efficiency), and

- SPI is less than 100% (working efficiency).

To summarize the four scenarios and prescribed forecasting methods:

| Scenario | Method | |

|

1 |

The project’s current CPI will continue to the end. (The default method for the PMP® Exam) |

EAC = BAC ÷ CPI |

|

2 |

The project may have had issues, but is expected to continue as originally planned. |

EAC = AC + BAC – EV |

|

3 |

The project plan has blown up. Re-estimate the remaining project work from scratch. |

EAC = AC + bottom-up ETC |

|

4 |

The double-whammy: Over budget AND behind schedule! |

EAC = AC + (BAC – EV)÷(CPI x SPI) |

This series on forecasting concludes! What will be my next post? I can’t begin to forecast it – I don’t know the scenario yet!