OK, without any more details provided, then I think I will go with “risk averse.” I prefer less risk than more risk, in most cases. Risk is uncertainty; I prefer to make decisions and take action based on certainties.

In our projects, there is always uncertainty. If we are more risk tolerant, then we may choose to accept more uncertainty rather than responding to those identified risks with a definite strategy. Where we draw the line about accepting risks or not is based on our level of risk tolerance. As we manage projects, we should be in tune with our organization’s tolerance for risk rather than our personal risk tolerance.

Decisions about the application of risk response strategies are made in the process called Risk Response Planning. However, much of the heavy lifting is done in a supporting process called Perform Quantitative Risk Analysis. In this analysis process, we gauge the amount of money in the budget at risk or the amount of time in the schedule that is uncertain for specific activities. Once we know the expected level of cost uncertainty related to particular project aspects, then we can decide where to “draw the line” with risk acceptance based on the organization’s financial strength and risk tolerance.

One technique applicable in this process is Expected Monetary Value Analysis (EMV). Yes, the word “expected” brings to mind that probabilities and statistics may come into play. How much financial impact (money) do we expect a particular risk event to influence the project, good or bad? A threat may impose a negative cost impact while an opportunity might present a financial gain. If we are risk averse and want to mitigate financial risk, we might create a contingency or reserve amount of money to offset the impact of risk events actually occurring. How much reserve is adequate? Let’s take a look at EMV as a quantitative method to determine reserve.

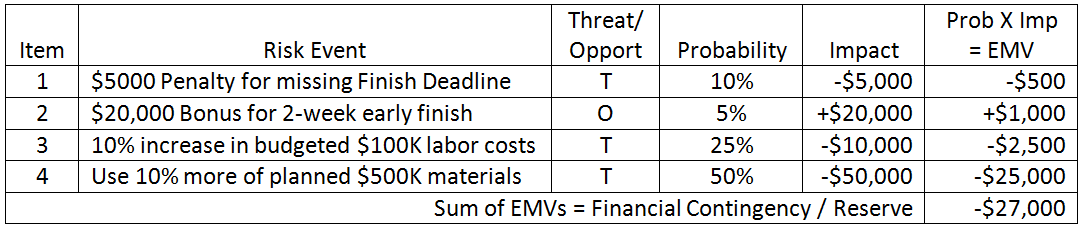

For example, in the table below, listed are a few threats and opportunities related to Project PQR. The EMV concept is to multiply the probability of the event’s occurrence times the positive or negative impact of the event if it were to occur. Summing the EMV of the threats and opportunities guides the risk manager in determining an appropriate amount of contingency funds, or reserve, for the project.

The sum of the impacts listed is -$45,000. If all of the risks identified in the list occur, then the $27,000 in reserve will not totally mitigate the impact. In a more realistic, longer list of identified risks, it is more probable that not all of the events will occur.

As you prepare for the PMP® Exam, learn how to apply the mathematics behind Expected Monetary Value Analysis – there is a 63.29% chance that such a question will appear! Don’t risk not knowing how to apply EMV toward PMP® certification success!

Of course, my friend Andy also told me that 65% of all statistics are wrong, so don’t take that 63.29% estimate to the bank!